Bailout on the Big Screen

It’s hard to believe it was just eight years ago.

On Sept. 15, 2008, Lehman Brothers, the Wall Street bank, collapsed. So did the stock market and, with consumer confidence plunging, U.S. auto sales. America entered its worst financial crisis since the Great Depression. The government bailed out the biggest banks. Some months later it did the same for General Motors and Chrysler.

My take on the bailout hasn’t much changed over the years. It was like changing a diaper: dirty, necessary and cleansing.

The two automakers went through a government-sponsored bankruptcy and restructuring in the spring of 2009. Ford barely escaped. Since then all three Detroit companies have mounted remarkable comebacks, making their near-death experiences a distant memory. Today’s hottest automotive issue, developing cars that drive themselves, seemed like science fiction back then.

Meanwhile today — Sept. 16, 2016 — exactly eight years and one day since Lehman’s collapse, a documentary film about America’s auto bailout debuts on the big screen. Titled Live Another Day, the movie is based on Crash Course, my 2010 book about the bailout.

The movie and the book differ in some respects. That’s normal, given different formats and the time lapse between them. To me the great strengths of the film — I confess bias, of course — are its vivid evocation of the desperation of the day, its plethora of voices and the airing of issues that remain controversial. Producers Bill Burke and Didier Pietri could have produced a polemic, but to their credit they didn’t.

My take on the bailout hasn’t much changed over the years. It was like changing a diaper: dirty, necessary and cleansing. President Barack Obama’s automotive task force operated under enormous pressure, and got it mostly right. Here’s why.

The most controversial issue was whether giving public money to bail out private companies even was justified. The best rationale was never “saving the American auto industry.” Had GM and Chrysler collapsed, foreign automakers would have picked up the slack.

That’s exactly what happened in the United Kingdom 22 years ago, when the last major British car company failed. “The sheer stupidity and immorality of this betrayal is too scandalous to be ignored,” fumed a Times of London columnist. Yet today, under foreign (largely Japanese) ownership, the British auto industry is stronger than ever.

The big issue, instead, was saving the American economy. The liquidations of GM and Chrysler might have caused a chain reaction and transformed the Great Recession of 2009 into another Great Depression. It would have been foolhardy to find out. The bailout was one of the few things on which Presidents George W. Bush and Obama agreed.

Another controversy was the dismissal of the CEO of General Motors, Rick Wagoner. To this day people question whether government officials should have fired, in effect, the head of a private company.

It’s a fair question. But in any bankruptcy restructuring, the provider of the “bridge financing” to keep the company going calls the shots. GM’s financing was provided by the American government, because no private lenders could or would step up.

Besides, Wagoner’s record as CEO had big blemishes, even before the financial crisis. Among them: partnering with Fiat in a deal that cost GM $2 billion to unwind, diversifying into home mortgages just before the housing market collapsed and presiding over huge losses in market share, profitability and the stock price. He had successes too, including GM’s expansion in China. Wagoner’s honorable behavior before and after leaving GM elicits understandable sympathy. But sadly, he was not a successful CEO.

Ford’s avoidance of bankruptcy is ascribed, by some, to sheer luck, because the company borrowed billions just before the crisis to tide it through. But Ford made its own luck. Besides the timely borrowing, the company replaced its CEO twice in the years before the crisis while the GM board did nothing.

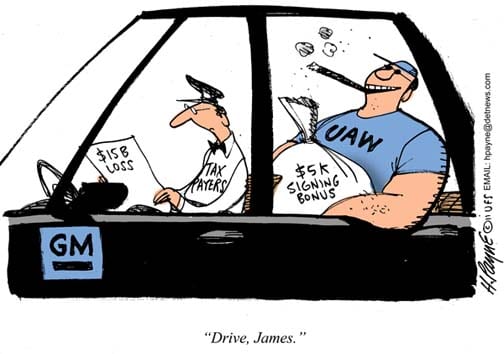

The Chrysler bailout was especially controversial, for good reason. Fiat got control of the company without paying anything. And holders of Chrysler secured debt recovered only about 30 cents on the dollar while a big unsecured creditor — the United Auto Workers union — got 55% of the company. Since then, Fiat’s woes in Europe coupled with Chrysler’s recovery in America has produced role reversal with the latter, in effect, bailing out the former.

Whew, where to start on this one? Subsequent events notwithstanding, Chrysler badly needed Fiat in 2009. Its product pipeline was bare, its management ranks thinned and its coffers empty. And had Chrysler failed, the secured creditors would have fared even worse than they did. The bailout terms survived legal challenge, including the Supreme Court. The task force required the UAW to make significant concessions, but there’s no denying that the union was treated well by a president it helped elect.

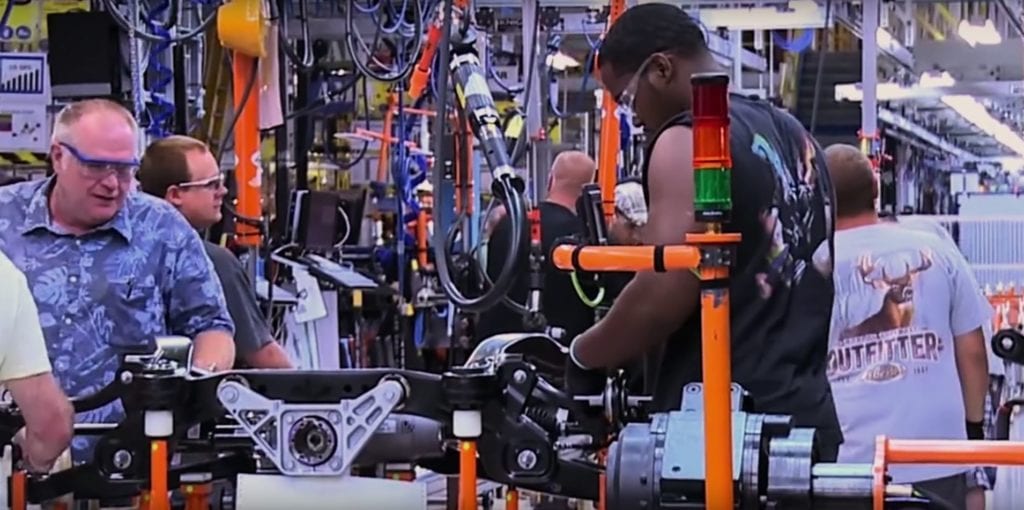

Speaking of the UAW, it does not fare well in Live Another Day. The film acknowledges the union’s positive role in defending workers’ dignity between the 1930s and 1960s. But then came the Seventies and Watergate, defeat in Vietnam and stagflation. (Not to mention bell-bottom pants and disco dancing.)

During that sorry decade the UAW evolved from defending workers’ rights to defending featherbedding. The “jobs bank” paid workers indefinitely for not working. Restrictive work rules required hiring extra people to, say, repair machinery, even though almost anyone could have done it. The UAW figured out that striking a key components factory could shut down an entire company, let workers at other factories collect unemployment benefits and stoke the union’s strike fund. The whole safety net got so heavy that it dragged down the very companies that funded it.

Then came the bankruptcies and the bailout, ultimately costing U.S. taxpayers some $10 billion. All of which is examined again, with the perspective of distance, in Live Another Day. It was a painful, almost desperate time whose lessons are still being debated today.

If you see the film, I’d be interested in your thoughts, and perhaps in sharing them with other readers of this site. Email me at [email protected].